Log in:

> Member

Your Super

- How it works

Super is designed to help you save for retirement. It’s not complicated if you know a few key things. - Fees and costs

ANZ Staff Super is low on fees and big on value. - Growing your super

Flexible contribution options to ensure you make the most of your super. - Combining your super

Combine all your super into one and avoid paying multiple fees. - Investing your super

Choose from four investment options that you can mix and match. - Insurance cover

Flexible and competitively priced insurance arrangements. - Your spouse can join too

You can build super for your spouse by opening a Spouse Contribution Account. - Financial advice

Get the advice you need to help you achieve your financial goals.

Super is designed to help you save for retirement.

It’s made up of compulsory parts, such as the Super Guarantee (SG) contributions your employer pays for you, and non-compulsory parts, such as the amounts you put in to boost your super savings. Over your working life, your super contributions accumulate. This money is also invested and the money earned on these investments is added to your account.

Special tax treatment applies to your super contributions and earnings. But to enjoy the favourable tax rates for super contributions you’ll need to ensure your contributions are within Government determined contribution limits.

For more information, read Superannuation facts and figures.

Fees and charges apply but our size and ANZ’s support allow us to keep costs low.

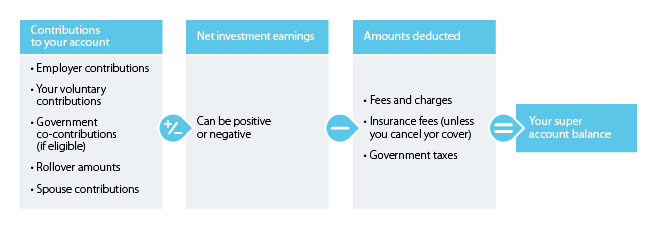

The building blocks of super are therefore:

Fees and costs

ANZ Staff Super is low on fees, big on value.

Our size and ANZ’s support help us to keep fees and charges down. Our Employee Section is rated #1 for low fees by research company Chant West* and all sections have a simple, competitive fee structure leaving more money invested in your account for your future.

Details of the fees and charges for each section can be found in the relevant Product Disclosure Statement in the Documents page.

Growing your super

Your employer is required to pay Super Guarantee contributions into your super on your behalf. The question is will that be enough to provide the lifestyle you want in retirement?

For most people, the answer is likely to be no. But don’t worry, there’s plenty you can do to give your super a boost, including a number of contribution options.

- Voluntary contributions

Making additional contributions from either your before-tax or after-tax salary is a great way to boost your super.

Making contributions from before-tax salary is known as salary sacrifice and is subject to agreement by your employer. These contributions are treated as employer contributions, so are subject to a 15% contributions tax. Because this may be lower than your marginal tax rate, there may be tax benefits to contributing to your super this way.

Voluntary contributions made from after-tax salary are not taxed when they go into your super.

- Government co-contributions

If you make voluntary after-tax contributions, the Government will add up to 50 cents for every dollar you contribute (up to a maximum of $500) if you:- earn under $57,016 in 2022/23

- have given us your Tax File Number

- lodge a tax return for 2022/23

- are under 71 years at 30 June 2022

- earn at least 10% of your income as an employee or by running a business

- are a permanent resident of Australia.

- How to make voluntary contributions

Members of the Employee Section and Employee Section C can make voluntary contributions by adding a MyPay request on PeopleSoft Employee Self Service. If you need help setting up or changing your voluntary contributions, call People Assist on 1800 65 25 35.

Members of the Personal Section should contact their current employer to make voluntary contributions

To make lump sum contributions, you can use BPAY (log in for your BPAY payment details, if you have already logged in, go to Your details page for your BPAY number) or send a cheque together with an Application to make lump sum contributions form to us.

The sooner you start adding to your super, the bigger the boost to your final benefit. Even small contributions can make a big difference. To see the difference a little extra can make, use our Model My Super calculator.

Contribution limits

There are limits on the amount that can be contributed to your super for favourable tax treatment. Exceeding the limits for either before-tax or after-tax contributions may mean you pay higher rates of tax.

For more information, read Superannuation facts and figures.

Combining your super

If you have multiple super accounts, you’re probably paying multiple sets of fees, which could add up over time.

By rolling your super accounts into your ANZ Staff Super account you could save on costs, giving you more money invested over time for your future. Your super also becomes easier to manage, giving you greater control.

It only takes a couple of minutes to simplify your super and save money. Log in to your account with your member number and PIN or password and go to the Find my super page. You can search for any other super accounts through the ATO data bases. Your results will show in a matter of minutes and you can request to consolidate some or all of any other accounts online. If you don’t know your member details, call us on 1800 000 086.

If you know the details of your other fund/s, you can request to rollover your other account /sonline on the Find your super page. You'll need the fund's name or ABN and your other account or member number, which you can find on your previous fund's statement.

Or you can also complete a Rollover form and return it to us.

Before consolidating, you should make sure you understand any fees or costs associated with the rollover and the impact it may have on any insurance you hold.

Employee Section members who have insurance cover attached to another super fund account* can apply to have it transferred to their ANZ Staff Super account by completing an Individual Insurance Transfer form. Members of other sections cannot apply to transfer insurance cover attached to other super fund accounts.

If you’re not sure where your super is, we can help! Call us on 1800 000 086 to provide us with your consent to use your Tax File Number (TFN) and we’ll start the search.

* Excludes SMSF, funds not regulated by APRA and internal transfers within the Scheme.

Insurance cover

ANZ Staff Super offers flexible and competitively priced insurance arrangements that vary by section:

- Employee Section

Automatic death and Total and Permanent Disablement (TPD) cover is provided to most new employees and Employee section members can choose the level of cover they need. You also have the option to apply for salary continuance insurance.

Learn more

- Employee Section C

Employee Section C members may choose to have death and Total and Permanent Disablement (TPD) cover if under age 60. You can select Multi-level Cover or No Cover. You also have the option to apply for salary continuance insurance.

Learn more

- Personal Section

Members transferred to the Personal Section can continue their chosen level of death and TPD cover.

Learn more

- Partner Section

Partner Section members can apply for death and TPD cover at any time.

Your spouse can join too

The partner (including de-facto and same-sex partners) of members of the Employee Section, Employee Section C and the Personal Section can apply to join ANZ Staff Super’s Partner Section.

Some of the advantages of your partner having a Partner Section account include:

- If your spouse earns $40,000 or less, you may be able to claim a tax rebate (or offset) for making an after-tax contribution to their super. To be eligible, your spouse must be under age 70 and must meet a ‘work test’ if they are age 65 or over. To make an after-tax contribution to your spouse's super, complete a Making a contribution on behalf of your spouse form.

- your spouse may be eligible for a Government co-contribution on contributions your spouse makes to the account,

- your spouse may be eligible for death cover and age-based Total and Permanent Disablement (TPD) cover, and

- there may be taxation advantages on splitting superannuation contributions with your spouse.

For more information about the Partner Section, read the Partner Section Product Disclosure Statement. To apply to become a spouse member complete the Application for Membership (Partner Section) in the PDS.

Financial advice

If you need advice regarding your super or retirement options, all you have to do is call an ANZ Staff Super financial adviser on 1800 000 086. They can help work out the right strategy for you no matter what your stage of life and provide you with advice over the phone.

The Trustee of ANZ Staff Super has entered into an agreement with Mercer Financial Advice (Australia) Pty Ltd under which Mercer's financial advisers have been engaged to provide members with general or limited personal financial advice about options available within ANZ Staff Super over the phone for no extra charge.

These financial planning services are provided by Mercer Financial Advice (Australia) Pty Ltd ABN 76 153 168 293, AFSL #411766. Any advice provided by Mercer's advisers is not provided or endorsed by the Trustee and is not provided under the Trustee's AFSL.

Calling from Overseas: +61 3 8687 1829

8.00am - 6.00pm

Monday - Friday (AEST/AEDT)